John Greenwood, Chief Economist of Invesco for the inflation, money, for Friedman and Thatcher

The Currency Boards are attractive to the ordinary citizen but unappealing to politicians, said Greenwood

Friedman was a delightful individual with sparkling humour and a brilliant teacher, said the economist

- Mr. Greenwood, you are the chief economist at Invesco, an investment management company supervising $1.6 trillion of assets. You employ a monetarist model that states that macroeconomic developments revolve around changes in the money supply. If the money supply surges, asset prices surge, then with a lag, the real economy surges, and finally with another lag of about 2 years, inflation rears its ugly head. So, how does Invesco guide investments with what you anticipate to be elevated and persistent inflation for the next 2-3 years?

- Invesco manages money under many different mandates (equities, real estate, bonds and cash as well as ETFs) in numerous different economies so not all portfolios follow the same strategy. However, with the rapid growth of the broad money supply since the onset of Covid-19, especially in the US and to a lesser extent in other economies such as the Euro area, UK, Canada, Australia and New Zealand, for the past 18 months, I have advocated full exposure to risk assets such as equities and real estate, and minimal exposure to bonds (other than index-linked or inflation-protected bonds). In the bond markets, rising interest rates resulting from higher inflation will likely lead to losses by bond investors over the next 3-5 years.

- You and Prof. Steve Hanke are friends, colleagues, and have trained many of the same people--when you were in Hong Kong and Prof. Hanke was at Johns Hopkins in Baltimore. I suppose you have the same views about how the world works. Is that true? I see that you often write together. How did that come about? Do you often compare notes? You have become a centerpiece in Prof. Hanke's famous Friday seminar on Problems in Applied Economics. How did that come about? And what motivates the chief economist at a $1.6 trillion fund to participate in a seminar aimed at training young students?

- Yes, Prof Hanke and I share the same framework for our analysis of “how the world works.” We like to collaborate because we have complimentary skills in analysis, in writing and with our media contacts. In recent years we regularly met at Prof. Robert Mundell’s conference in Siena, Italy, and since the onset of Covid-19 we have talked several times each week by telephone.

My teaching at Prof Hanke’s class is in part due to my teaching experience here in the UK where, over the past 20 years with the encouragement of Invesco, I have taught a course on Asian economies and exchange rate policies at Cardiff University; and in part a result of preparing a series of video lectures for the Heriot Watt and Edinburgh University Business Schools. The contents of these video lectures, which focus on case studies of macroeconomic experience drawn from many different economies, have proved ideal for students of the Hanke seminar on applied economics. As a practising economist, I believe it is important to keep one foot in the academic world and one foot in the business world!

- How did the introduction of the currency board in Hong Kong come about? What do you remember as most memorable? What do you remember about your work with Sir Alan Walters, Margaret Thatcher’s adviser? Do you still have a role in the Hong Kong Monetary Authority?

- I had studied as a postgraduate student in Japan in the early 1970s, specialising in Japan’s monetary policy and the business cycle. In 1974, I moved to Hong Kong and extended my analysis to all the smaller East Asian economies from South Korea down to Australia and New Zealand and across to India. As a vehicle for my research, in 1976 I started publishing a bi-monthly journal called Asian Monetary Monitor which did what it said on the cover – we monitored monetary conditions across Asia. In those days we did not have access to computers so we had to collect the data from statistical publications or directly from central banks and government agencies, drawing charts or preparing tables by hand.

Hong Kong proved a special challenge both because of the paucity of data and the lack of any authoritative analysis of the unusual monetary system. However, I made steady progress, sharing my analysis with the top monetary scholars I knew – Alan Walters, Milton Friedman and Max Fry. Consequently, when the Hong Kong dollar crisis developed in 1982-83 as a result of the Sino-British negotiations over the future of Hong Kong after 1997, I had three possible monetary solutions for Hong Kong ready for adoption. I had not worked with Sir Alan previously, but I knew him on a personal basis, and when my plan was ready we arranged for a copy to be flown by Concorde to Washington (where he was living). He was able to quiz me by phone in Hong Kong and present my proposals to Mrs Thatcher when she visited Washington for the IMF-World Bank meetings in September 1983. The end result was that the UK government endorsed my plan, but it was left to the (British) Hong Kong government to make the announcement and take care of the details of implementation in October 1983.

Yes, I still have a role at the Hong Kong Monetary Authority where I have served as an external member of the Currency Board Committee since 1998. During the Covid-19 pandemic, these meetings have necessarily been “virtual” meetings, but I expect physical meetings will resume in 2022.

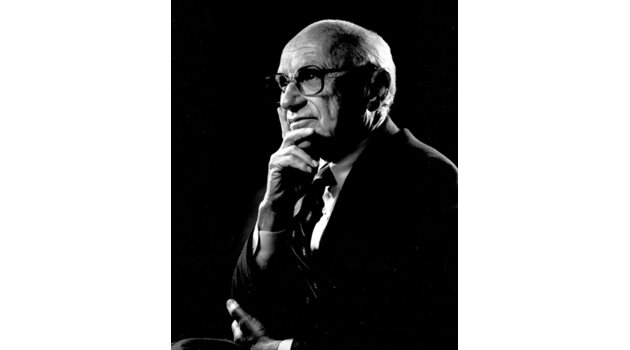

- I know that Prof. Hanke’s mentor is Prof. Milton Friedman. Did you know him?

- I knew Milton Friedman well. I first met him in Tokyo in 1969 and we became good friends through our common research interest in monetary policy. In 1978 I joined the Mont Pelerin Society which he had helped establish in 1946, so we met regularly at MPS conferences as well as in Hong Kong when Friedman visited (e.g. when he was making his “Free to Choose” TV series) or in California when I went to live there between 1994 and 1998. In his biography with his wife Rose, “Two Lucky People” you will find numerous references to me. Friedman was a delightful individual with sparkling humour and a brilliant teacher. He was always able to explain even the most complicated subject in simple terms so that even a non-economist could understand.

- If currency boards suppress inflation, reduce corruption, and ensure stability, why aren't there more of them?

- It is politicians in government who select the monetary system of their country and generally they have chosen to have central banks rather than currency boards because the central bank comes with a range of powers that are attractive to politicians – such as the ability to use the central bank to finance government spending, the ability to manage interest rates and the exchange rate, and the greater prestige generally associated with a central bank. By design a Currency Board limits the power of the government or politicians to intervene in the monetary system and effectively imposes a “hard budget” constraint on government spending, requiring disciplined budgets, orthodox finances and the accumulation of substantial reserves. These features are what make Currency Boards attractive to the ordinary citizen but unappealing to politicians.

- How can ordinary people keep their savings in the face of rising inflation?

- Not all countries are going to face inflation in the aftermath of the Covid-19 pandemic – only those economies that have witnessed very rapid money growth. The countries where inflation will increase the most are the US, Israel and Brazil; in contrast, three countries that have not allowed rapid money growth include Switzerland, Japan and China. One strategy is to allocate most of your assets to equities and real estate since they are well-protected against inflation. Another is to hold the currencies of those economies where the inflation rates will be lowest since these currencies are likely to appreciate in value relative to the higher inflation currencies.

- Why were you awarded the Order of the British Empire?

- I was awarded the OBE in 1994 by the British administration in Hong Kong for my “services to the Hong Kong economy”. This included my work on the stabilisation of the HK$ in 1983 as well working as an adviser to the HK Government, as a member of the Stock Exchange Listing Committee and a director of the HK Futures Exchange Clearing Corporation. In addition, last year I was awarded the Silver Bauhinia Star (SBS) by the Hong Kong SAR Government for my services in helping to stabilize the Hong Kong dollar. (The bauhinia flower is the emblem of Hong Kong.) It is gratifying to have been recognised by both the British and Hong Kong Chinese governments for my contribution to prosperity and stability in the territory before and after the handover of sovereignty in 1997.

- Did you know Margaret Thatcher?

- During the 1970s and 1980s when Margaret Thatcher was Britain’s Prime Minister I was living in Hong Kong, so I only met her when I went to live in London after 1999. By that time she had retired and I met her through the Mont Pelerin Society which held a meeting in London. She mentions the Hong Kong dollar episode and Alan Walters’ role in her autobiography, “The Downing Street Years” pp.489-90. She quotes the financial press as calling the stabilization of the HK$ as “an unalloyed success.”