Prof. Steve Hanke: Ronald Reagan Reagan defended me for the privatization

The economist shares interesting stories related to his friends John Greenwood, Milton Friedman and Robert Mandel

Mrs. Hanke imported the word privatization from France, said Prof. Hanke

- How did you meet Mr. Greenwood? What do you remember?

- I met John in a spontaneous way. Sir Alan Walters, who was my closest colleague and collaborator at the Johns Hopkins University, informed me that the best materials on money and banking in Asia were contained in The Asian Monetary Monitor, a publication John Greenwood edited in Hong Kong. So, I was introduced long distance to Greenwood and his work, and we began to correspond. That resulted in two of my best students, Dr. Kurt Schuler and Dr. Christopher Culp, becoming interns with Greenwood in Hong Kong. So, John and I knew each other very well before we actually had the pleasure of meeting face-to-face.

- You managed the world’s most profitable fund in 1995; he is the chief economist of a fund that manages $1.6 trillion. Are investments the basis of your friendship? Or the general views on the economy? Or the fact that both of you are the architects of some currency boards?

- Greenwood and I have a very deep friendship that is solidified by many shared interests, including investments, general views on economics, and, of course, currency boards. And if that’s not enough, Mrs. Hanke and Mrs. Greenwood are friends, too.

- Do your articles in the Wall Street Journal cause reactions?

- Our Wall Street Journal articles are given the most careful and anxious attention by those in circles of influence. For example, just this past summer, Greenwood and I wrote a Wall Street Journal article that resulted in a telephone call and invitation for Mrs. Hanke and I to attend a dinner party in Newport, Rhode Island. Newport is where those with “old money” reside in the summer season. It’s the place made famous by the Vanderbilts, the Morgans, the Astors, and the Kennedys. Indeed, Newport is where Jack and Jackie were married. Back to the invitation. Our host, who we have known for 30 years, informed us about the dinner venue in which he had invited 20 billionaires. He promised a great evening. And great it was. I capped the evening off with an after-dinner speech about the investment implications implied by the Greenwood-Hanke WSJ article. That was Sunday evening. The dinner guests were moving their money on Monday morning.

- You had very curious dialogue with the founder of Twitter, Jack Dorsey. He said he expects hyperinflation in the United States, and you answered him that hyperinflations are very rare and that there have only been 62 episodes in world history. Did he react to your comment?

- Dorsey did react via Twitter, of course. After I scolded Dorsey for misusing the word “hyperinflation,” he stopped using that word.

- Bulgaria has currency board in which the lev is a clone of the euro, but the ECB continues to print money. What could be the consequences for Bulgaria?

- Well, the printing of money by the ECB has not been nearly as excessive as the U.S. Federal Reserve. So, inflation will be much more muted in the Eurozone. Since Bulgaria is de facto part of the Eurozone because of its currency board and the fact that the lev is a clone of the euro, inflation in Bulgaria next year will be 3% or slightly above, while inflation in the U.S. will be 6% or slightly above.

- In the EU, countries like Italy, Spain, and Greece have accumulated huge debts. On the other hand, there are countries like Bulgaria with low debt levels. What lessons can we learn from these debt disparities?

- Bulgaria has much more fiscal discipline than virtually all Eurozone countries thanks to its currency board. If Bulgaria formally joins the Eurozone, the currency board’s straitjacket around its politicians will be thrown out the window. Without the straitjacket, government waste, fraud, and abuse would definitely increase in Bulgaria. That’s why I am totally opposed to Bulgaria’s adoption of the euro and formal entry into the Eurozone. Any Bulgarian who votes for a politician favoring the abandonment of Bulgaria’s currency board and the adoption of the euro will, in fact, be voting for more Bulgarian corruption.

- What topics are you discussing at your famous Friday seminars at the Johns Hopkins University, which are attended by Mr. Greenwood? Are there other experts who attend?

- Some of the topics of discussion have been “Why Money Matters for Investors,” “How Money is Created,” “Quantifying the Impact of Money,” “Money Creation and the Exchange Rate,” “Money and Shadow Banking,” “Money Counterpart Analysis,” “Case Studies of Hong Kong and Australia,” “Money and Credit in Financial Bubbles and Busts,” and “Case Studies of Sweden and Thailand.” In addition, each week we always review what’s going on in the world markets and why it’s important.

This term, I lead the Friday seminars, with John as a primary contributor, plus Denis McHugh. Denis is a former student, a very experienced trader, and is now the Chief Risk Officer at the Bank of Montreal. Both John and Denis are Fellows at the Johns Hopkins Institute for Applied Economics, Global Health, and the Study of Business Enterprise, which I founded and co-direct. We also have other distinguished visitors. For example, Jacques de Larosiere, who is a family friend, former Managing Director of the IMF, former Governor of the Banque de France, and former President of the European Bank for Reconstruction and Development, joins us on occasion from Paris. So, the seminar operates at a very high level. It’s what I call a “precision drill.” It’s quite exciting. To my great satisfaction, Wall Street places a very high value on my students.

- Did you know Sir Alan Walters? What can you tell us about him? Some stories?

- Mrs. Hanke and I knew Sir Alan very well. He was my closest colleague at Johns Hopkins. We taught courses together, we edited two books together, and we co-authored a regular column “Point of View” in Forbes Magazine for many years. In addition, I was the one who introduced Sir Alan to the insurance giant, the American International Group, where he became Vice Chairman. But perhaps most importantly, Sir Alan introduced me to John Greenwood and currency boards. Our work on currency boards included a co-authored entry for “Currency Boards” in The New Palgrave Dictionary of Economics, which is the most authoritative publication of its kind in economics.

I have hundreds of stories about Sir Alan.

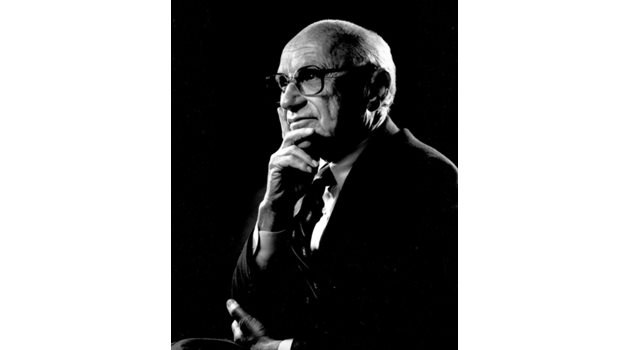

- Could you tell us some stories related to your mentor Milton Friedman?

- Milton was a very tough, but very funny and generous mentor. He was also a big supporter of currency boards. In 1992, he publicly endorsed my currency board proposal for Estonia, a currency board that was installed in June 1992. Also, in 1992, Mrs. Hanke and I, along with Milton and Mrs. Friedman, traveled to Mexico City to try to convince the Mexican authorities to adopt a currency board to protect the peso from what we predicted would be a collapse. We didn’t win the prize in 1992, but we were vindicated in December of 1994, when the peso collapsed and set off the famous Tequila Crisis. Milton also publicly backed my proposed currency board for Indonesia in 1998.

As an example of Milton’s generosity, allow me to tell you a little story. We had been talking a lot about the stock market, when out of the blue, on August 6, 1996, I received a package of materials from Milton which contained all of his background work on what he called his “Bubble Detector” model of the stock market. He said that he didn’t have time to fully develop it, but that I could. I called him to thank him and ask if he wanted to co-author an article on the “Bubble Detector.” He said, “No, you have given me quite a few ideas on it,” which was quite a huge exaggeration, and said that whatever I did with the “Bubble Detector” was fine with him and required no acknowledgment to him.

- What would you say about Robert Mundell?

- Robert “Bob” Mundell was a great friend—a man with a certain genius quality. Mrs. Hanke and I spent many summers in Tuscany at Palazzo Mundell, where I was part of Mundell’s inner circle, along with John Greenwood. In fact, when I received my Doctorate, Honoris Causa in 2013 from the Bulgarian Academy of Sciences, a private jet was sent to Tuscany to retrieve Mrs. Hanke and myself and take us to Sofia.

When I told Bob that I was writing a book on currency boards in 1993, he invited me to lunch in New York City so that I could present my ideas to him. I did, and he fully agreed and endorsed the currency board idea. Mundell was a big devotee of Bulgaria’s currency board. And when I say “Bulgaria,” I recount one dinner in Dubai, where Bob and I were members of the United Arab Emirates Financial Advisory Council. Bob told Mrs. Hanke that he had to excuse himself early because he had to retrieve his camera from a Bulgarian that he had forgotten it with the last time we were in Dubai. Mrs. Hanke and I said nothing, but just looked at each other in a knowing way, thinking, “A Bulgarian in Dubai?” When it came to anything connected to Bulgaria, Bob would consult me. For example, before making the symbolic first move in the World Chess Championship in Sofia in 2010, Bob called me for a briefing on Bulgaria. Bob thought that the Bulgarian currency board was the type of system that should be adopted in emerging market countries. He was very critical of the International Monetary Fund for not aggressively advocating currency boards like Bulgaria’s.

- You were an adviser to the great president Ronald Reagan? What kind of man was he?

- I first met President Reagan in 1974, when I was a Professor at the University of California at Berkeley and Reagan was the Governor of California. We were both part of what was, at the time, known as the National Tax Limitation movement. Later, I became part of Reagan’s White House staff as a member of his Council of Economic Advisers. It was there that Reagan gave me the responsibility for developing his privatization proposals.

Maybe the most notable part of that assignment was the introduction of the word “privatization” into the English language. I was giving a speech in Reno, Nevada, in which I was advocating the privatization of great swathes of the lands owned by the federal government. These are a huge Socialist chunk of the U.S.A. They are six times larger than France. As Mrs. Hanke reviewed my speech in our hotel room at the MGM Grand, she said that I had to change the language to say that it was “privatization” that I was advocating. Well, at that time, that word wasn’t in Webster’s Collegiate Dictionary because it was a French word Mrs. Hanke had brought with her from Paris. I started to use “privatization” in public speeches, and we eventually had the word entered into Webster’s Dictionary.

The ladies thought Reagan was, as they would say, very handsome. For me, he had the look of an old-fashioned Hollywood star. But, more importantly, when he entered the room, things just sort of lit up. He was very charismatic. He had very strong ideas about liberty. These are all expressed in hundreds of speeches that he wrote in his own hand before he became President. These were written without any advisers whispering in his ear. He was much more intellectual than the portrayals of him in the press. He was relaxed, charming, and very loyal. But, when pushed into a corner, he could be ruthless. When the Secretary of Interior James Watt demanded my head for advocating the privatization of government lands, Reagan came to my defense and told the Secretary that if he didn’t like what I was proposing, then the Secretary could resign.

- Did you know Margaret Thatcher? Would you compare her to Reagan? What did they look like? Were there differences in their approaches?

Unfortunately, I never had the pleasure of meeting Mrs. Thatcher. The only British Prime Minister that I know and worked closely with is Sir John Major. We both served together on the International Advisory Board of the National Bank of Kuwait.

- Were you involved in the work around the currency board in Hong Kong?

No, I was not involved in the establishment of Hong Kong’s currency board. That’s John Greenwood’s baby. That said, I was involved in saving the Hong Kong system from what would have been a fatal blow. One Sunday afternoon in July 2020, Secretary of State Mike Pompeo called me. He indicated that the United States was going to impose financial sanctions on Hong Kong, and that a final decision would be made by President Trump the next day. But, before the meeting in the White House, Secretary Pompeo had been instructed to obtain my opinion. We spoke via telephone for 35 minutes. Pompeo was adamantly for sanctions. I was adamantly against. Monday afternoon, the White House called to tell me, “Hanke you won. There will be no financial sanctions against Hong Kong and its currency board.”